INE Confirms Inflation Rise to 2.3% in October

Across the Eurozone, inflation also ticked up, reaching 2% in October, driven primarily by rising prices for food, alcohol, and tobacco.

What?

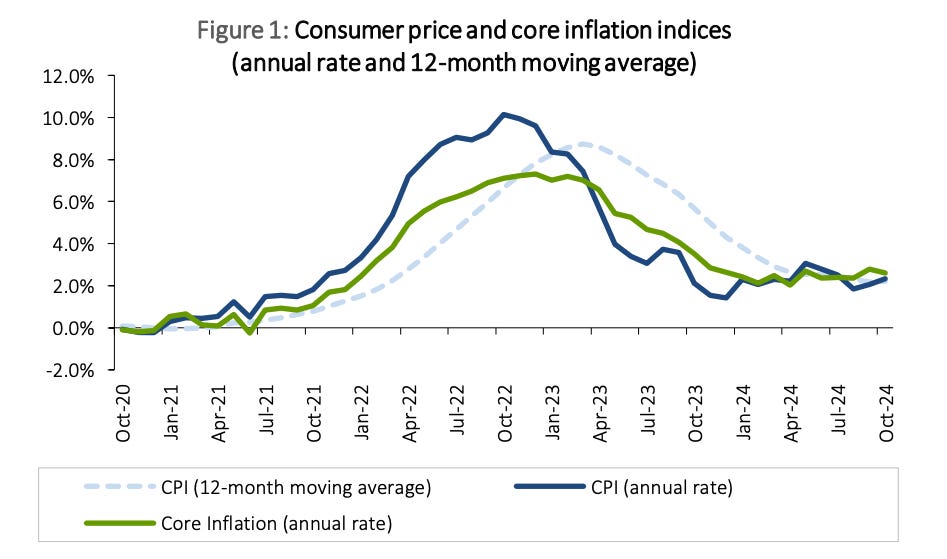

Portugal’s year-on-year inflation rate rose to 2.3% in October, an increase of 0.2 percentage points from September, according to the National Statistics Institute (INE).

The figure aligns with the earlier flash estimate released on October 31, indicating a modest acceleration in consumer prices.

The nitty-gritty

The core inflation rate, which excludes volatile items such as unprocessed food and energy, slowed to 2.6%, down from 2.8% in the previous month.

The INE noted a shift in energy price dynamics, with the energy index recording a decline of 0.2%, a significant improvement from the 3.5% drop seen in September.

This shift was attributed to a monthly rise in energy prices and the base effect from a sharp drop in October 2023.

Meanwhile, prices for unprocessed food saw a notable increase, rising by 2.1%, compared to just 0.9% in September, highlighting ongoing volatility in food costs.

On a monthly basis, consumer prices rose by 0.1% in October, following a significant jump of 1.3% in September. Excluding food and energy, the index fell slightly by 0.1%, reflecting subdued price pressures in other sectors.

The Harmonised Index of Consumer Prices (HICP) for Portugal, which aligns with EU measurement standards, showed a year-on-year increase of 2.6%, unchanged from September. This was 0.6 percentage points higher than the Eurozone average, which came in at 2%, according to Eurostat.

Eurozone Inflation Holds Steady Amid Sticky Core Prices

Across the Eurozone, inflation also ticked up, reaching 2% in October, driven primarily by rising prices for food, alcohol, and tobacco.

Despite the increase, core inflation, which excludes these volatile categories, remained steady at 2.7%.

The European Central Bank (ECB) expressed confidence in its ongoing disinflation efforts, citing sluggish economic activity as a dampening factor for inflationary pressures.

However, the stickiness of services inflation, which held at 3.9%, suggests domestic price pressures are still persistent.

Market analysts are revising expectations for the ECB’s next moves. Kyle Chapman of Ballinger Group noted that stronger-than-expected growth and low unemployment have reduced the likelihood of aggressive rate cuts.

Chapman anticipates a series of 25 basis point hikes rather than a steeper easing, as the ECB navigates the challenge of persistent inflation in the services sector.