IMF upgrades Portugal's growth

The organization predicts the country's GDP will grow 1.7% in 2024, which is slightly more optimistic than the Government.

What?

The IMF has revised Portugal’s economic growth upwards to 1.7% this year, which is slightly more optimistic than the Government, cutting the inflation rate to 2.2%.

In the “World Economic Outlook” (WEO), published as part of the spring meetings of the International Monetary Fund (IMF) and the World Bank, the institution led by Kristalina Georgieva points to an expansion in Gross Domestic Product (GDP) of 1.7% this year and 2.1% in 2025.

Compared to the report released in October last year, this forecast represents an upward revision of 0.2 percentage points (p.p.) for 2024 and a cut of 0.1 p.p. for 2025.

Tell me more

The IMF is more optimistic than the Portuguese Government, which in the 2024-2028 Stability Programme forecasts growth of 1.5% this year and 1.9% next under a no-policy-change scenario.

In the update of the Public Finance Council’s (CFP) forecasts, published this month, the organisation led by Nazaré da Costa Cabral maintained the growth of the Portuguese economy this year at 1.6% and predicts an expansion of 1.9% in 2025.

EU comparison

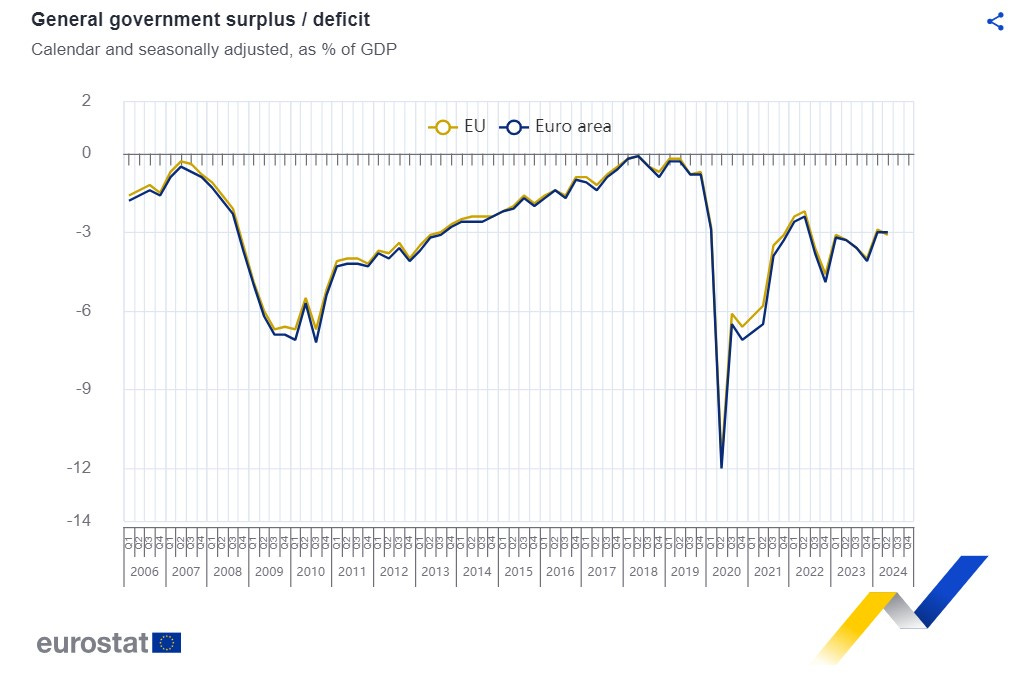

According to data released by Eurostat this week, the public deficit in the eurozone stood at 3% of GDP and 3.1% in the European Union during the second quarter of 2024, with Portugal recording the fourth-largest surplus (2.6%).

Between April and June, Portugal recorded the fourth largest budget surplus, after Cyprus (4.6%), Denmark (3.3%) and Ireland (3.1%).

Poland (-8.1%), Romania (-7.1%), France and Slovakia (-5.5% each) had the largest public deficits in the second quarter.

Public debt

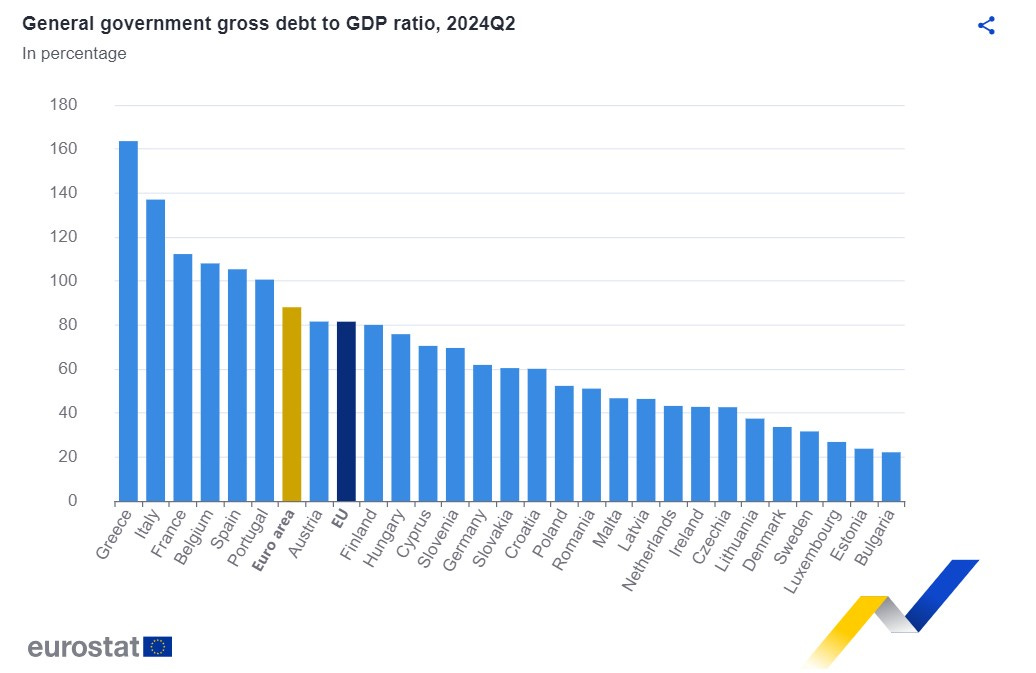

The EU's statistical office also reported that the ratio of gross public debt to Gross Domestic Product (GDP) in the euro area stood at 88.1%, down from 88.8% a year earlier and up from 87.8% in the first quarter of the year.

For the 27 member states as a whole, the debt-to-GDP ratio fell between April and June from 81.9% a year earlier, but rose from 81.3% in the first quarter.

The highest debts were recorded in Greece (163.6%), Italy (137.0%), and France (111.2%), with Portugal in sixth place (100.6%), and the lowest in Bulgaria (22.1%), Estonia (23.8%), and Luxembourg (26.8%).

In the second quarter, Portugal registered the third-largest year-on-year reduction in public debt (-8.1 percentage points) and the fourth-largest quarter-on-quarter increase (1.2 percentage points).