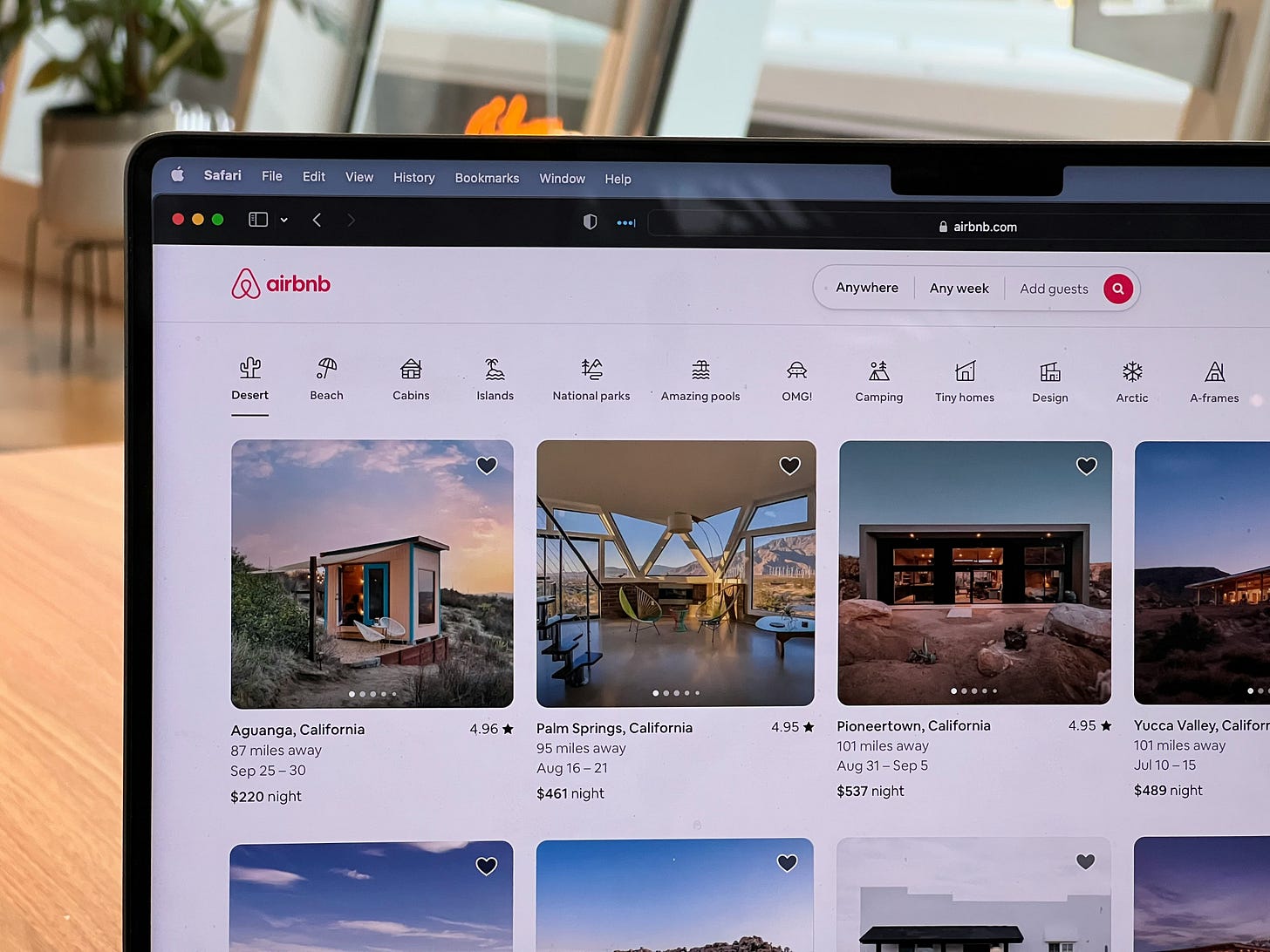

Government relaxes laws on short-term rentals

The Government also approved new rules regarding municipal taxes, capital gains from property and displaced workers.

On Thursday, the Government approved a decree-law that removes the power of condominiums to shut down short-term rentals units, putting the final decision back in the hands of local councils.

“This decree went through the obligatory consultations,” by the National Association of Portuguese Municipalities (ANMP) and the autonomous regions of the Azores and Madeira, said the Minister of the Presidency, António Leitão Amaro.

He added: “and it also means the fulfilment of the electoral commitments regarding the short-term rentals’ rules to balance of interests between investors and condominium owners.”

The decree reverses the provision from the Mais Habitação (“More Housing”) package adopted by the previous Socialist Government that enabled two thirds (66 %) of the condominium's permillage to decide on the compulsory closure of the unit, within 60 days of the decision.

According to the Minister, ‘more than half’ of the condominium owners’ permutation can still request the closure of the unit, but the final decision will be up to the municipality, after a negotiation process. As part of the negotiation between the parties, ‘municipal regulations may provide for the appointment of a “local accommodation ombudsman” to support the owner of the unit’.

If, at the end of the negotiation process, the municipality decides to cancel the LA, the unit will have to remain closed for a period of five years.

In addition, the government will exempt short-term rentals’ owners from having to obtain prior authorisation from the condominium to open their business in a residential building, as has been required until now.

At the moment, it is only possible to set up a short-term rental unit in a building that is intended, in the constitutive title, for housing, if the condominium unanimously approves the change of use of the building, in accordance with the changes introduced to the short-term rental legal regime by the previous Government under the Mais Habitação package.

‘Whenever the local accommodation establishment is registered in an autonomous fraction of a building under horizontal property regime that is intended, in the constitutive title, for housing, the registration must be preceded by a decision by the condominium for use other than the exercise of the local accommodation activity,’ determines law no. 56/2023 of 6 October. And, it adds, this ‘decision’ must be approved unanimously.

For Leitão Amaro, it's a question of ‘repealing the mistakes of the previous government’ and focusing on ‘decentralising the regulation’ of the short-term rental market.

Other measures

The Government also approved a decree-law that eliminates the Extraordinary Local Accommodation Contribution (CEAL) - a 15% fixed rate on a variable taxable base - and the rule that prevented municipal tax reductions (IMI) based on an age coefficient on these properties.

The extraordinary 15% tax as well as the age coefficient applied to these properties, which prevents the age of the buildings from being reflected in the IMI reduction, have been eliminated with effect from 31 December 2023. Retroactivity thus ensures that the owners of these businesses don't pay the tax.

It should be remembered that this tax had to be paid by 15 June, however, the current Executive postponed the deadline for paying the tax for 120 days, which corresponds to four months, until 15 October, until it managed to approve the repeal of the regime, which has now happened.

Since the approved law takes effect on 31 December 2023, i.e. it relates to last year's financial year, LA owners will no longer have to pay the tax this year for the taxable event of 2023.

Without going into too much detail, the Minister of the Presidency, António Leitão Amaro, announced during the Council of Ministers briefing that the government had approved ‘a decree authorised by Parliament that implements the law that abolishes the extraordinary contribution on short-term rentals and creates rules on IRS’.

The same decree facilitates the exemption from IRS of capital gains generated by the sale of a house and reinvested in the purchase of their own permanent home.

The Executive also legislated to allow a worker who has moved more than 100 kilometres from his or her home to deduct the cost of rent for the new home from the property income obtained from renting out the original home.

However, for this to be possible, other requirements must be met, in addition to distance: the property generating the property income must have been used as the worker’s own permanent home or that of their household for at least 12 months before it was rented out; both rental contracts must be registered on the Tax and Customs Authority’s Finance Portal.